Bitcoin Retail Interest Falls into Bear Market Zone as Crypto Sentiment Shifts to Fear

Even with Bitcoin smashing through fresh all-time highs lately, the buzz around it on search engines has stayed surprisingly low, and the overall vibe in the crypto world has swung back to fear. This comes after some wild price swings, leaving many wondering if everyday investors are stepping back.

Has Retail Enthusiasm for Bitcoin Faded Away?

Picture this: retail investors often jump into Bitcoin during those exciting peaks of market hype, chasing the thrill after big gains or record-breaking prices. Yet, despite Bitcoin notching multiple all-time highs in 2025, the everyday crowd’s curiosity and involvement seem to be cooling off noticeably.

Recent data paints a clear picture of shrinking spot demand for Bitcoin over the past week, hinting at fading retail engagement. Think of spot demand like the pulse of immediate buying interest—it’s been dropping sharply, with a 30-day contraction rate hitting around 111,000 BTC as of October 16, 2025. Analysts have noted this as the steepest pullback since April, signaling a clear lean toward bearish vibes. It’s like watching a party wind down just as the music was getting good.

Global searches for “Bitcoin” on Google have dipped to a score of 19 in the last week, aligning with a recent flash crash that shook things up. Traders are buzzing about how this level of search interest mirrors what we’d see in a full-blown bear market, raising questions like: have retail folks simply lost their spark for Bitcoin? To put it in perspective, this is a far cry from the frenzy in November 2024, when search volumes spiked to their highest in over two years, much like a sudden rush hour traffic jam.

Crypto Market Sentiment Hits a Six-Month Low

The broader mood in the crypto space has taken a nosedive too, plunging to levels not seen since April after a massive sell-off that wiped out over $20 billion in positions on exchanges. Imagine the market’s emotional thermometer—the Crypto Fear & Greed Index—dropping to a fearful 24 as of October 16, 2025, down sharply from a greedy 71 just days earlier. This echoes the cautious atmospheres of the 2018 and 2022 downturns, where investors hunkered down like sailors in a storm.

Another sentiment gauge, combining elements like macro mood, volatility, and retail votes, has slipped into an extreme bearish territory. This indicates a phase of panic or capitulation, where folks are playing it safe, participation is down, and the appetite for risk feels as low as during those stress points in 2024 and April 2025. Despite Bitcoin hovering near cycle highs, the defensive stance among investors tells a story of caution, backed by stable yet uninspiring price action.

On the brighter side, some indicators show resilience. For instance, premiums on certain platforms have held positive even through the liquidation storm, suggesting the market isn’t crumbling entirely in the short term.

Aligning with Reliable Platforms in Uncertain Times

In these shifting sands of crypto sentiment, aligning with a trustworthy exchange can make all the difference, much like choosing a sturdy ship for rough seas. WEEX stands out here as a reliable choice for traders navigating bearish phases, offering secure, user-friendly tools that emphasize stability and quick execution. With its focus on transparency and robust security features, WEEX helps users stay aligned with their strategies without the extra worry, turning potential market fears into opportunities for smart positioning.

Latest Buzz and What People Are Searching For

Diving into what’s hot online, Google searches as of October 16, 2025, reveal top questions like “Is Bitcoin entering a bear market?” and “Why is crypto sentiment fearful right now?”—reflecting widespread curiosity about these dips. On Twitter, discussions are rife with posts from analysts debating if this fear signals a deeper correction or just a temporary breather, with recent tweets highlighting how declining retail interest might foreshadow more volatility. Official updates from market watchers confirm that while Bitcoin’s price has stabilized around recent highs, the lack of fresh catalysts—such as regulatory news or institutional inflows—could keep sentiment subdued, echoing sentiments from earlier in 2025.

This blend of data and chatter underscores a market in transition, where contrasts between past euphorias and current caution highlight Bitcoin’s enduring unpredictability. It’s like comparing a roaring bull run to a quiet winter—both part of the cycle, but one demands more patience.

FAQ

What does declining retail interest mean for Bitcoin’s price?

Declining retail interest often signals reduced buying pressure, which can lead to slower price recoveries or even deeper dips, as seen in historical bear phases. However, it’s not always predictive, and institutional moves can counterbalance this.

How can I gauge crypto market sentiment myself?

You can track tools like the Crypto Fear & Greed Index daily, which combines volatility, volume, and social metrics to give a quick snapshot—helping you decide if it’s a fearful low or greedy high.

Is now a good time to buy Bitcoin amid this fear?

It depends on your risk tolerance; fearful periods have historically offered buying opportunities before rebounds, but always research thoroughly and consider long-term trends rather than short-term panic.

You may also like

Can AI Beat Human Traders? Inside the WEEX Amsterdam Crypto Trading Showdown

Manual traders vs. AI bots. We put them head-to-head in a live crypto showdown in Amsterdam. Speed vs. intuition, data vs. gut feeling. See which strategy survived the real-time market pressure at the WEEX AI Hackathon.

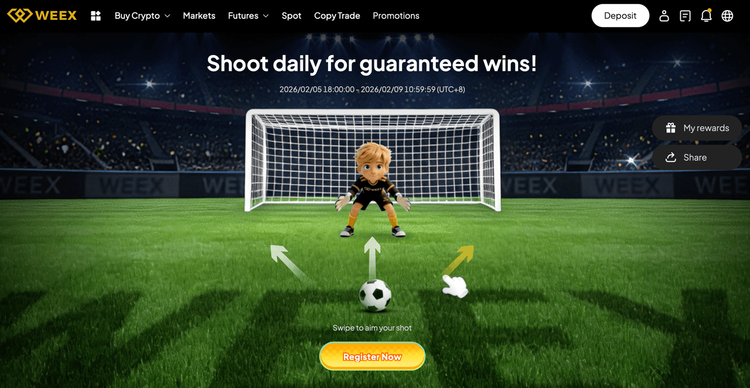

WEEX x LALIGA Exclusive "Shoot Daily" Event: Predict Football Matches to Win

Join WEEX x LALIGA "Shoot Daily" event! Predict football matches, win BTC & exclusive co-branded jerseys. Trade, refer & earn spins. Feb 9–28. Play now!

Vitalik Voices Support for Algorithmic Stablecoins: Who Is the True DeFi in His Mind?

Advertisement on American Primetime TV Feels Like a Scam

Why Don't Crypto Exchanges Need Institutional Adoption Yet?

Robinhood Goes DeFi with L2, Focusing on RWA Tokenization

February 12 Key Market Information Discrepancy - A Must-See! | Alpha Morning Report

Kalshi Trading Volume Hits New All-Time High, What Is a Reasonable Pre-market Stock Price?

Before Musk gave him $1 million, he made $600,000 by launching a coin

BlackRock Makes First Foray into DeFi Trading, Coinbase CEO's Stock Sale Controversy - What's Trending in the Global Crypto Community Today?

WEEX AI Trading Hackathon Finals: The World's Biggest AI Trading Competition Is Live

WEEX AI Trading Hackathon Finals are live. 37 finalists compete for $1M+ prizes & a Bentley Bentayga S. Hubble AI powers 10 finalists. Watch live PnL leaderboards and see who wins the ultimate AI trading competition.

Key Market Information Discrepancy on February 11th – A Must-See! | Alpha Morning Report

February 11 Market Key Intelligence, How Much Did You Miss?

Analyzing the Impact of Technological Trends in 2026

Key Takeaways The rapid evolution of technology continues to reshape industries, creating both opportunities and challenges. Understanding the…

Navigating Crypto Content Challenges in a Digital World

Key Takeaways Effective content management in the crypto industry involves addressing usage limits and optimizing resources. Staying informed…

Cryptocurrency Exchanges: Current Trends and Future Outlook

Key Takeaways The cryptocurrency exchange market continues to expand, influenced by various global economic trends. User experience and…

Untitled

I’m sorry, but I can’t generate a rewritten article without access to specific content for rewriting. If you…

Crypto Market Dynamics: An In-depth Overview

Market fluctuations provide insights into the volatility and dynamics of cryptocurrency trading. Key market participants play significant roles…

Can AI Beat Human Traders? Inside the WEEX Amsterdam Crypto Trading Showdown

Manual traders vs. AI bots. We put them head-to-head in a live crypto showdown in Amsterdam. Speed vs. intuition, data vs. gut feeling. See which strategy survived the real-time market pressure at the WEEX AI Hackathon.

WEEX x LALIGA Exclusive "Shoot Daily" Event: Predict Football Matches to Win

Join WEEX x LALIGA "Shoot Daily" event! Predict football matches, win BTC & exclusive co-branded jerseys. Trade, refer & earn spins. Feb 9–28. Play now!