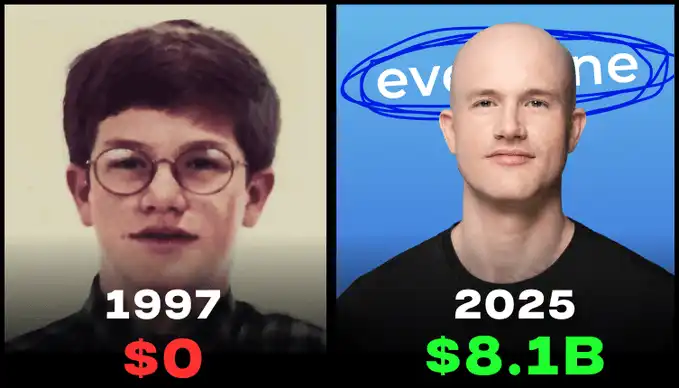

From Candy Vendor to Crypto Billionaire: Coinbase Founder's $8 Billion Startup Rule

Original Author: TRACER

Brian Armstrong is one of the wealthiest figures in the cryptocurrency field. He founded the Coinbase exchange and earned $8 billion in just five years, making him one of the world's top investors according to Forbes. Here are his Memecoin secret, strategy, and five major predictions.

The significant development of the cryptocurrency industry needs to be grateful to a few individuals, and Brian Armstrong is one of them. He entered this field due to a belief in technology and completely changed his life trajectory with his belief in Bitcoin. Brian Armstrong's growth experience and industry insights are worth revisiting repeatedly, drawing insightful revelations:

Brian was born in San Jose, California, with an entrepreneurial potential from a young age. In an interview, he once admitted that he was called into the principal's office for selling candy on the school playground. During high school, he developed a passion for internet technology and started learning to code.

He later pursued his studies at Rice University and obtained a master's degree. After graduation, he chose to live in Buenos Aires, Argentina, for a year, where he witnessed severe hyperinflation. The method to combat this economic turmoil—cryptocurrency—became the direction he would delve into in the future.

After graduating from college and going through a series of jobs, he co-founded a platform with his friends that matched private teachers with students. The platform allowed teachers to post personal information and offer teaching services to potential student clients. Brian Armstrong served as the CEO of the project for eight years, eventually selling it for a price equivalent to 21 times his annual income.

During Christmas 2010, Brian Armstrong first learned about Bitcoin while staying at his parents' home in San Jose. He stumbled upon the seminal document written by Satoshi Nakamoto—"Bitcoin: A Peer-to-Peer Electronic Cash System." From that moment on, he began contemplating a venture.

He held a guiding principle for entrepreneurship: "The one who gets rich isn't the gold miner, but the one selling shovels." At that time, there was a direct competitor in the industry, namely the famous Mt. Gox, but that platform suffered from serious transaction latency issues. In 2021, Brian Armstrong and Fred Ehrsam officially registered Coinbase.

Coinbase has begun to receive a large amount of investment, with a valuation that is more than eight times Brian's original target. He had initially planned to create a $1 billion company. Today, Brian Armstrong is living the dream, holding a fortune of millions. He is also actively sharing his insights and advice, which you should definitely consider:

Currently, Brian Armstrong firmly believes that it is necessary to reform cryptocurrency regulatory policies. The previous government severely hindered the industry's development, and now is the best time to correct this issue. There is discussion across the board regarding the appointment of an SEC chairman who supports cryptocurrency and the establishment of a clear and stable legal framework, which is a significant positive for the cryptocurrency market.

Brian Armstrong holds a very positive view of Memecoins and believes they have some development prospects. In his view, just as GIFs and internet memes have become a part of the internet economy, Memecoins could also become an important cultural and even economic phenomenon. This is a significant perspective that is worth thinking deeply about.

Brian also shared a media browsing tip: you should never listen to the promoters on YouTube. When analyzing a project, pay particular attention to 3 key elements:

GitHub code contribution quantity Team's activity on Twitter and Discord Responsiveness to critical opinions, if the project team remains silent, this is a danger signal. The new Trump administration's policies could significantly increase institutional fund flows into the market, all driven by government actions that will effectively enhance the confidence of financial institutions, with the core driving force being the government's advancement of relevant legislation regarding stablecoins and the digital dollar.

Brian Armstrong believes that cryptocurrency will never replace the traditional financial system but will complement it powerfully. Exchange-Traded Fund (ETF) trading, asset custody services, and deeply integrated products with banks and fintech platforms will be the development trend. This is essentially a practical suggestion: be sure to develop products that can interface with the traditional financial architecture.

You may also like

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

GameStop 2.0? Why Robinhood’s CEO Advocates Tokenization for Trading Halts

Key Takeaways Tokenized stocks are seen as a solution to counteract the disruptions seen in traditional equity markets…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Solana Loses Major Portion of Validators as Smaller Nodes Exit: Concerns Over Centralization

Key Takeaways: Solana has experienced a significant drop in active validators from a high of 2,560 in March…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Gold to $10,000 and Silver to $150: My Wild, Or Perhaps Not-So-Wild 2026 Price Predictions

Key Takeaways Geopolitical uncertainties are significantly driving up the demand for gold and silver, suggesting the prices may…

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…