How Did the “Zombie Coin” Suddenly Come Back to Life?

Wasn't it supposed to be a bull market where "new projects are hot, old projects are not"? What is XLM? And what about HBAR? I've never even heard of these coins, yet they are mysteriously surging in price?

What Are Korean Moms Buying?

Who is actually buying these "zombie coins"? In short: "institutional buying pressure" led by the United States and "retail buying pressure" led by Japan and South Korea. The institutional buying pressure from the U.S. is well known, but let's take a look at the data from neighboring South Korea.

According to a report by a South Korean media outlet naver.news, on the active crypto exchanges in Korea, Upbit and Bithumb, the number of users over the age of 60 has increased by 30.4% compared to the previous bull market, reaching 770,000 accounts. Moreover, considering the wealth distribution in Korea, the elderly collectively hold 6.76 trillion Korean Won in cryptocurrency assets, with an average investment of about 8.72 million Korean Won per person. At the same time, the amount of money held in Korean banks has hit a new low, decreasing by 26.95 trillion Korean Won since the end of June. It seems like Koreans are withdrawing money from banks to "hoard" and buy coins.

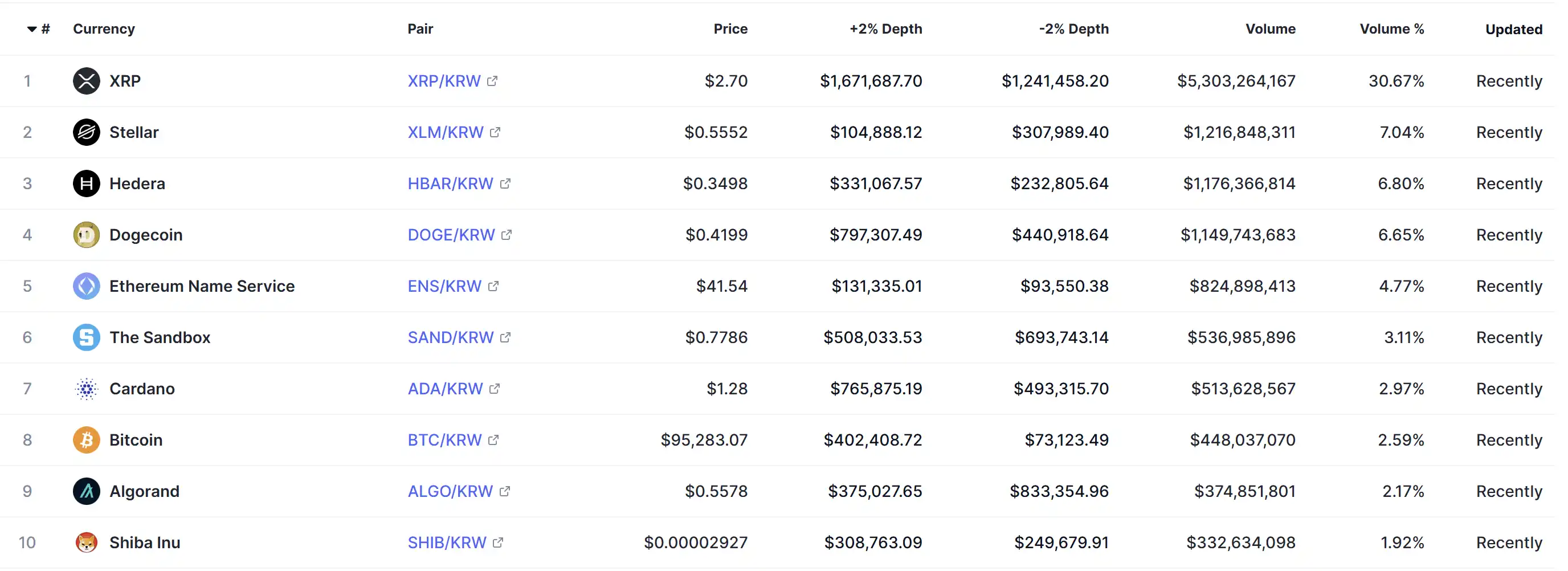

Below is the trading volume list from Upbit in Korea, where you'll find BTC being just a "little brother" in this ranking. XRP's trading volume is over 10 times that of BTC, and projects like XLM (Stellar) and HBAR (Hedera), which are rarely seen in the Chinese-speaking community, are also "famous" on the list.

XRP

One of Ripple's flagship products is RippleNet, which is a global payment network connecting banks and payment providers to facilitate secure and near-instant cross-border transactions. Ripple's technology includes its Interledger Protocol (ILP), designed to reduce settlement times and significantly lower transaction costs, enhancing financial institutions' transparency and liquidity management. Furthermore, Ripple plans to issue stablecoins in the future, which could be a huge potential catalyst for its growth.

Upbit 24h Trading Volume: $55.57 billion

Binance 24h Trading Volume: $56.27 billion

HBAR (Hedera Hashgraph)

Hedera Hashgraph utilizes a novel algorithm called Hashgraph consensus to achieve high levels of scalability, security, and fairness. The platform aims to create and deploy decentralized applications (dApps) and services across various industries ranging from finance and supply chain management to gaming and social networks. Unlike traditional blockchains, Hedera Hashgraph adopts a Directed Acyclic Graph (DAG) structure to enable rapid and efficient consensus among network participants, resulting in fast transaction speeds and minimal energy consumption.

Upbit 24-hour Trading Volume: $12.24 Billion

Binance 24-hour Trading Volume: $12.97 Billion

XLM (Stellar)

The core of the Stellar network is the Lumens (XLM) cryptocurrency, which acts as a bridge asset facilitating seamless value exchange between different currencies, promoting cross-border transactions. Lumens also play a crucial role in preventing spam attacks, ensuring the security and reliability of the Stellar network. In addition to its payment functionality, Stellartron strongly supports micropayments and facilitates the issuance of digital assets through its decentralized exchange feature.

Upbit 24-hour Trading Volume: $12.64 Billion

Binance 24-hour Trading Volume: $7.36 Billion

ENS

ENS stands for Ethereum Name Service, providing a domain name service for Ethereum akin to how we access internet information through domain names today. Built on Ethereum, ENS enables users to purchase secure, private, censorship-resistant .eth domain names that can be used to link to cryptocurrency wallet addresses or other information stored on Web3 infrastructure. The ENS token has previously experienced price pumps due to endorsements by Vitalik Buterin, and in line with Vitalik's "aesthetic," retail investors in South Korea also have a fondness for ENS.

Upbit 24-hour Trading Volume: $8.41 Billion

Binance 24-hour Trading Volume: $1.66 Billion

SAND

Sandbox is a metaverse gaming platform on Ethereum, where users can create, share, and play with crypto assets. Sandbox has been relatively overlooked by the market recently, but Sand has become a favorite among Korean retail investors, with daily price surges exceeding 60% multiple times and a 24-hour trading volume double that of Binance.

Upbit 24-hour Trading Volume: $5.82 Billion

Binance 24-hour Trading Volume: $2.67 Billion

The Retail Investors' Battle Behind Wall Street: Unpacking the Launch Logic of Bull Market 2.0

However, it's not just about the old coins; there are also many compliant coins (including the ones mentioned above: XRP, HBAR, XLM). These coins share several commonalities: retail investors hardly pay attention to them, they were in a downtrend or consolidation phase before November 5, and they experience direct significant price surges without providing an opportunity to get on board beforehand. So why are these coins specifically chosen?

To understand these, we first need to clarify the underlying logic of this bull market.

This bull market mainly follows the United States. The Chinese information on Web3 actually exists in an "information silo." Many people do not know what happened in the United States, Japan, and Korea (which follows the U.S. market).

The start of this bull market and the logic of the first half of this year are fundamentally different. The first half of the year was a bull market driven by ETF positives, where the market followed meme and AI hype. Therefore, it was "hot coins" > others; the second half of the year is the compliance bull with the rise of knowledgeable insiders. Hence, the hype is around compliant assets, "compliant coins" > "hot coins" > others. The tokens that surged this time mainly comply with the ISO 20022 compliance standard.

ISO 20022 is the standard for electronic data interchange between financial institutions, covering financial information exchanged between financial institutions. ISO 20022 is more advanced than the traditional formats used by banks because it supports a larger amount of data and faster processing speed, making it very suitable for fast payments.

If a token complies with ISO 20022, it will be prioritized for international payments.

IOTA

The IOTA token is the native digital currency of the IOTA network, used to facilitate transactions and data transfer within the Tangle. Its feeless nature eliminates barriers to microtransactions, making it ideal for microtransactions in IoT scenarios. IOTA's focus on scalability, security, and seamless transactions aligns with its vision to become the foundational technology of the rapidly growing IoT industry.

Upbit 24h Trading Volume: $321 million

Binance 24h Trading Volume: $181 million

ALGO

Algorand focuses on scalability, low transaction fees, and fast confirmation times, making it suitable for a variety of applications, including financial services, decentralized finance (DeFi), and asset tokenization. One of Algorand's key innovations is its proprietary consensus mechanism, namely Pure Proof-of-Stake (PPoS), which enables fast transaction confirmation times while maintaining a high level of decentralization.

Upbit 24h Trading Volume: $388 million

Binance 24h Trading Volume: $317 million

ADA

Cardano (ADA) is a blockchain platform designed to provide a secure and scalable infrastructure for developing decentralized applications (dApps) and smart contracts. Cardano is developed using a research-driven approach, focusing on scalability, sustainability, and interoperability to address the limitations of existing blockchain technology.

Upbit 24-hour Trading Volume: $5.34 Billion

Binance 24-hour Trading Volume: $11.22 Billion

When Will the Bull Market End

However, when these coins skyrocket by 5 times, when will it all come to an end? Perhaps the answer lies behind the Korean Mom. Based on Upbit Altcoin's daily trading volume data, it can be seen that the recent volume has reached the peak of the March mini bull run. The daily trading volume of Upbit Altcoin can be seen as a signal indicator of bull market FOMO.

The bull market is a grand retreat, and when even the Korean Mom is caught up in FOMO, it often signifies a temporary peak.

You may also like

What the Tightest Part of the LALIGA Season Teaches About Crypto Trading Under Pressure

As pressure builds late in the LALIGA season, decision quality becomes the real differentiator. The same logic applies to disciplined crypto trading under volatility.

WEEX P2P now supports EGP, SAR, MAD & SYP—Merchant Recruitment Now Open

To make crypto deposits easier, WEEX has officially launched its P2P trading platform and continues to expand fiat support. We're excited to announce that the EGP (Egyptian Pound), SAR (Saudi Riyal), MAD (Moroccan Dirham), and SYP (Syrian Pound) are now available on WEEX P2P!

![[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards](https://images-cms.weex.com/medium_Win_a_Share_of_100_000_in_Rewards_75e69c3539.PNG)

[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards

Discover how WEEX VIP traders participate in the VIP Spot Sprint and compete for a share of the $100,000 rewards pool. Clear rules, performance-based rankings.

ETH Ecosystem Month: A $1.5 Million Trading Opportunity Focused on Ethereum Assets

Explore ETH trading opportunities on WEEX with ETH Ecosystem Month. A $1.5M campaign covering ETH spot trading, ETH futures rewards, leaderboards, and referral incentives across the Ethereum ecosystem.

Bitcoin 30-Day Realized Losses and Gold Reaching Record Highs

Key Takeaways Bitcoin holders have experienced a rare stretch of 30-day realized losses for the first time since…

Central banks vs Bitcoin: Who truly earns the public’s trust?

Key Takeaways The debate over trust between central banks and Bitcoin continues, receiving global attention at the World…

Trade Finance: Unleashing Blockchain’s Most Potent Opportunity

Key Takeaways Blockchain technology has the potential to revolutionize the $9.7-trillion global trade finance market by addressing its…

Kaspa is Expected to Decline to $0.032939 by January 26, 2026

Key Takeaways Kaspa’s price is projected to drop 23.07% within the next five days. Current market sentiment for…

Bitcoin Fills New Year CME Gap with Sub-$88K BTC Price Drop

Key Takeaways Bitcoin’s price has closed a significant CME gap that appeared at the beginning of the year,…

Massachusetts Judge Prohibits Kalshi from Offering Sports Bets

Key Takeaways A judge in Massachusetts has prohibited the prediction markets platform, Kalshi, from facilitating sports betting within…

Bitcoin Exhibits Resilience at $92K Amidst Economic Fluctuations: Is the Downturn Over?

Key Takeaways: Bitcoin remains robust at $92,000, though ETF outflows and geopolitical concerns loom. BTC futures premium close…

Crypto Mortgages in the US Tackle Valuation Risks and Regulatory Challenges

Key Takeaways The adoption of crypto mortgages is facing challenges around valuation risks and regulatory uncertainties in the…

Revolut Pursues Banking Expansion in Peru Amid Latin America Remittance Strategies

Key Takeaways Revolut seeks a banking license in Peru as part of its strategic expansion across Latin America,…

Former Alameda CEO Released from Custody After 440 Days

Key Takeaways: Caroline Ellison, former CEO of Alameda Research, has been released after serving 440 days in federal…

Can Bitcoin Regain $90K? Bulls at Risk as Long-Term Holders Increase Selling

Key Takeaways: Bitcoin has declined below the $90,000 mark amid increased selling pressure from whales and long-term holders.…

Michael Saylor’s Strategy Surpasses 700,000 Bitcoin with a New $2.1B Acquisition

Key Takeaways: Michael Saylor’s Strategy has significantly increased its Bitcoin holdings to an impressive 709,715 BTC after purchasing…

Untitled

I’m sorry, but it seems there is no original article provided for me to rewrite. If you could…

Bitcoin Pursues $90K: Trump to Fast-Track Crypto Legislation

Key Takeaways Bitcoin is gaining momentum as President Trump indicates imminent crypto-friendly legislation. Trump’s World Economic Forum speech…

What the Tightest Part of the LALIGA Season Teaches About Crypto Trading Under Pressure

As pressure builds late in the LALIGA season, decision quality becomes the real differentiator. The same logic applies to disciplined crypto trading under volatility.

WEEX P2P now supports EGP, SAR, MAD & SYP—Merchant Recruitment Now Open

To make crypto deposits easier, WEEX has officially launched its P2P trading platform and continues to expand fiat support. We're excited to announce that the EGP (Egyptian Pound), SAR (Saudi Riyal), MAD (Moroccan Dirham), and SYP (Syrian Pound) are now available on WEEX P2P!

[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards

Discover how WEEX VIP traders participate in the VIP Spot Sprint and compete for a share of the $100,000 rewards pool. Clear rules, performance-based rankings.

ETH Ecosystem Month: A $1.5 Million Trading Opportunity Focused on Ethereum Assets

Explore ETH trading opportunities on WEEX with ETH Ecosystem Month. A $1.5M campaign covering ETH spot trading, ETH futures rewards, leaderboards, and referral incentives across the Ethereum ecosystem.

Bitcoin 30-Day Realized Losses and Gold Reaching Record Highs

Key Takeaways Bitcoin holders have experienced a rare stretch of 30-day realized losses for the first time since…

Central banks vs Bitcoin: Who truly earns the public’s trust?

Key Takeaways The debate over trust between central banks and Bitcoin continues, receiving global attention at the World…