Technical Analysis: How was Balancer Hacked for $120 Million, and Where was the Vulnerability? On [date], Balancer, a popular decentralized exchange (DEX), was hacked for $120 million in a sophisticated attack. The vulnerability exploited in this atta...

Original Article Title: "Balancer $120M Hack Vulnerability Technical Analysis"

Original Source: ExVul Security

Foreword

On November 3, 2025, the Balancer protocol was attacked on multiple chains including Arbitrum and Ethereum, resulting in a $120 million asset loss. The attack was primarily due to a dual vulnerability involving precision loss and Invariant manipulation.

Chainlink's infrastructure has long maintained the highest standards in the Web3 space, making it a natural choice for X Layer, which is dedicated to providing institutional-grade tools for developers.

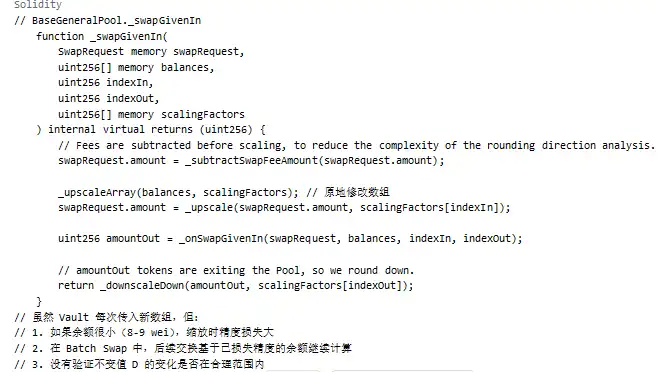

The key issue in this attack lies in the protocol's logic for handling small transactions. When users conduct exchanges with small amounts, the protocol invokes the _upscaleArray function, which uses mulDown for rounding down values. When the balance in the transaction and the input amount both hit a specific rounding boundary (e.g., the 8-9 wei range), a noticeable relative precision error occurs.

This precision error is propagated to the calculation of the protocol's Invariant value D, causing an abnormal reduction in the D value. The fluctuation of the D value directly lowers the price of the Balancer Pool Token (BPT) in the Balancer protocol. The hacker exploited this suppressed BPT price through a premeditated trading path to conduct arbitrage, ultimately leading to a massive asset loss.

Exploited Transaction:

https://etherscan.io/tx/0x6ed07db1a9fe5c0794d44cd36081d6a6df103fab868cdd75d581e3bd23bc9742

Asset Transfer Transaction:

https://etherscan.io/tx/0xd155207261712c35fa3d472ed1e51bfcd816e616dd4f517fa5959836f5b48569

Technical Analysis

Attack Vector

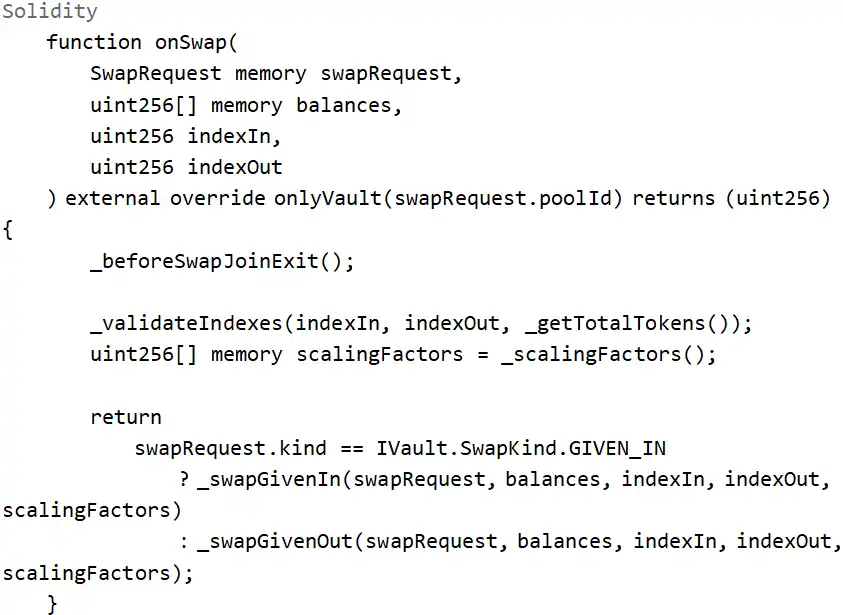

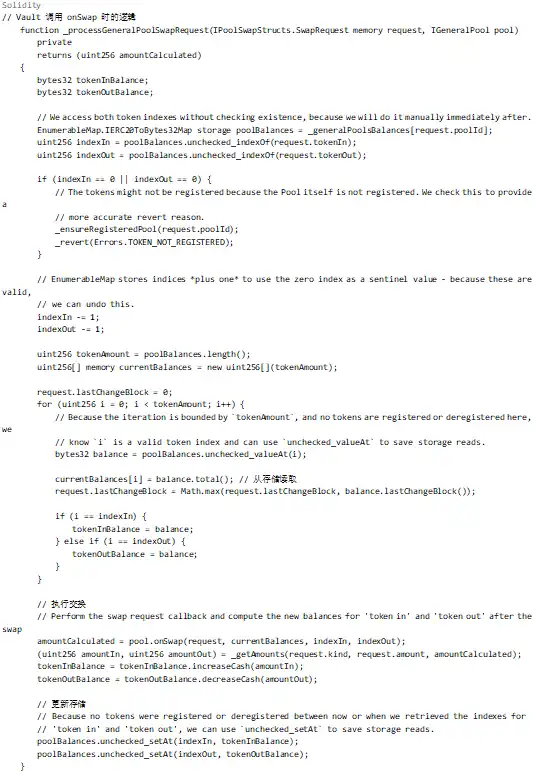

The entry point of the attack was the Balancer: Vault contract, with the corresponding entry function being the batchSwap function, which internally calls onSwap for token exchanges.

From the perspective of function parameters and restrictions, several pieces of information can be obtained:

1. The attacker needs to call this function through the Vault and cannot call it directly.

2. The function will internally call _scalingFactors() to get the scaling factor for scaling operations.

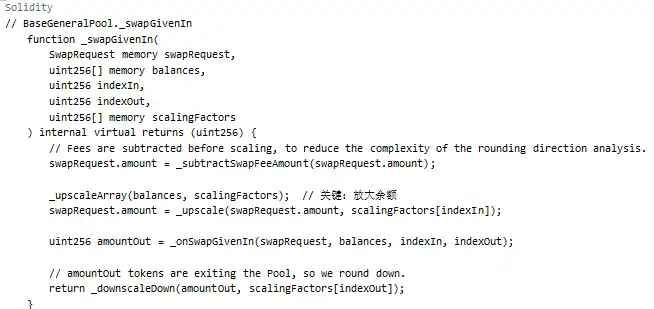

3. The scaling operation is concentrated in either _swapGivenIn or _swapGivenOut.

Attack Pattern Analysis

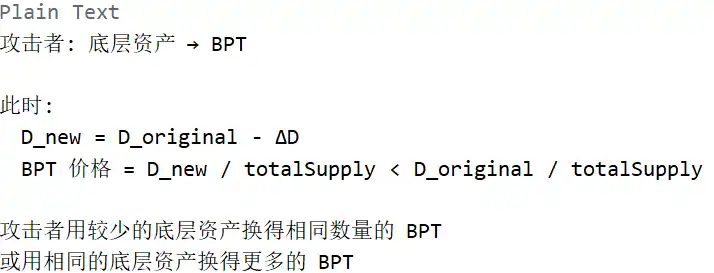

BPT Price Calculation Mechanism

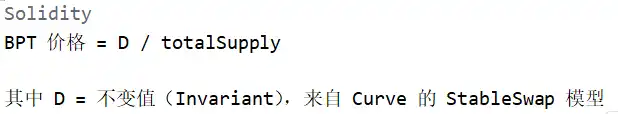

In Balancer's stable pool model, the BPT Price is a crucial reference point that determines how much BPT a user receives and how much each BPT receives in assets.

In the pool's exchange calculation:

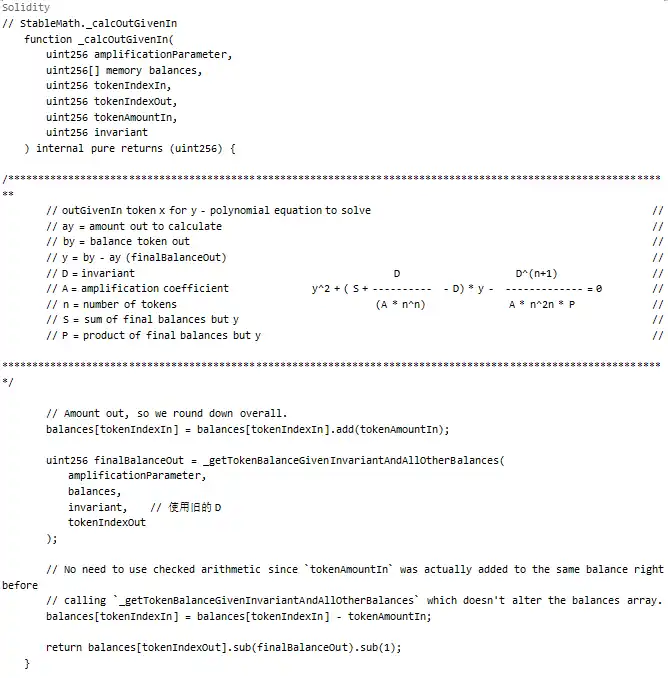

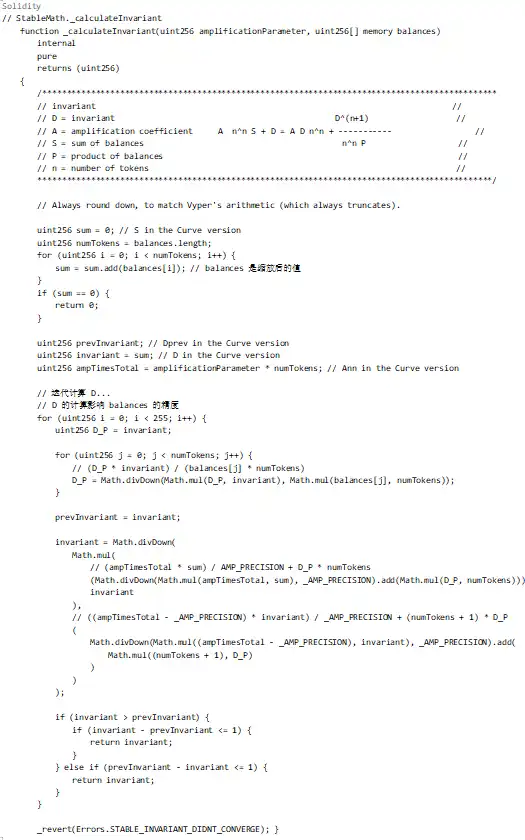

Where the part acting as the BPT Price anchor is an immutable value D, which means controlling the BPT Price requires controlling D. Let's analyze the calculation process of D further:

In the above code, the calculation process of D depends on the scaled balances array. This means that an operation is needed to change the precision of these balances, leading to an incorrect D calculation.

Root Cause of Precision Loss

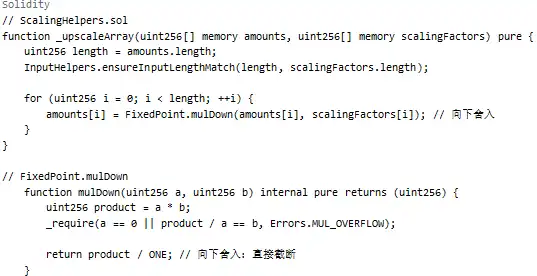

Scaling Operation:

As shown above, when passing through _upscaleArray, if the balance is very small (e.g., 8-9 wei), the rounding down in mulDown will result in significant precision loss.

Attack Process Detailed

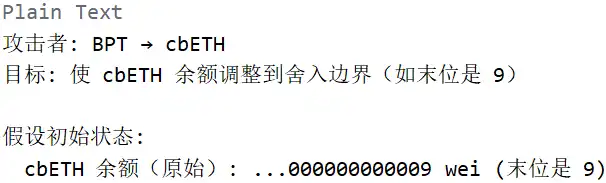

Phase 1: Adjustment to Rounding Boundary

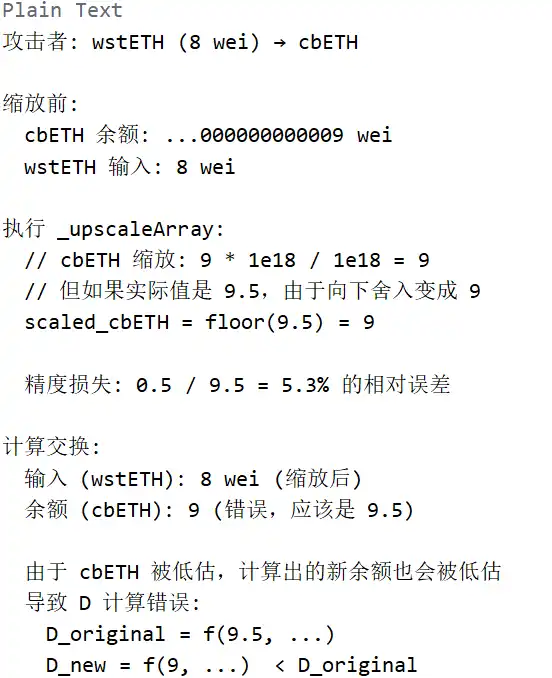

Phase 2: Trigger Precision Loss (Core Vulnerability)

Phase 3: Exploiting Depressed BPT Price for Profit

Above, the attacker uses Batch Swap to perform multiple exchanges in one transaction:

1. First Exchange: BPT → cbETH (balance adjustment)

2. Second Exchange: wstETH (8) → cbETH (trigger precision loss)

3. Third Exchange: Underlying Asset → BPT (profit-taking)

All these exchanges occur in the same batch swap transaction, sharing the same balance state, but each exchange calls _upscaleArray to modify the balances array.

Lack of Callback Mechanism

The main process is initiated by the Vault. How does this lead to accumulating precision loss? The answer lies in the passing mechanism of the balances array.

Looking at the above code, although Vault creates a new currentBalances array each time onSwap is called, in Batch Swap:

1. After the first swap, the balance is updated (but due to precision loss, the updated value may be inaccurate)

2. The second swap continues the calculation based on the result of the first swap

3. Precision loss accumulates, eventually causing the invariant value D to significantly decrease

Key Issue:

Summary

The Balancer attack can be summarized for the following reasons:

1. Scaling Function Uses Round Down: _upscaleArray uses mulDown for scaling, which results in significant relative precision loss when the balance is very small (e.g., 8-9 wei).

2. Invariant Value Calculation Is Sensitivity to Precision: The calculation of the invariant value D relies on the scaled balances array, and precision loss directly affects the calculation of D, causing D to decrease.

3. Lack of Invariant Value Change Validation: During the swap process, there was no validation to ensure that the change in the invariant value D was within a reasonable range, allowing attackers to repeatedly exploit precision loss to suppress the BPT price.

4. Accumulation of Precision Loss in Batch Swaps: Within the same batch swap, the precision loss from multiple swaps accumulates and eventually leads to significant financial losses.

These two issues—precision loss and lack of validation—combined with the attacker's careful design of boundary conditions, resulted in this loss.

This article is a contribution and does not represent the views of BlockBeats.

You may also like

Bloomberg: A Romanian Presidential Election Intervened by Crypto Traders

Founders Fund, Pantera, and Franklin Templeton join Sentient's "Arena" to stress test enterprise-level AI agents

Why Retail Is Shifting From Crypto to Equities: Will They Return?

Retail traders are exiting the crypto market and gravitating towards equities. Bitcoin saw a notable reduction in spot…

Canton Crypto Network vs. XRP: Understanding DTCC’s Strategic Approach to Infrastructure and Liquidity

Key Takeaways Canton Network and XRP serve distinct roles in blockchain technology: Canton for asset tokenization and atomic…

Jack Dorsey’s Block to Cut 4,000 Jobs in AI-Driven Restructuring

Key Takeaways Block’s significant job cuts aim to streamline operations for AI-driven growth. The company’s stock surged over…

Axiom Crypto Uncovered: ZachXBT Reveals $400k Insider Trading

Key Takeaways Allegations of insider trading at Axiom Crypto involve approximately $400,000 and a complex scheme where employees…

Ethereum 2029 Roadmap: ETH to Become the High-Speed Internet of Value

Key Takeaways Ethereum’s new roadmap, the “Strawmap,” aims for a settlement layer achieving 10,000 transactions per second (TPS)…

India Enhances Crypto KYC and AML Measures with Live ID and Location Checks

Key Takeaways: India classifies crypto exchanges as Virtual Digital Asset (VDA) service providers requiring enhanced Anti-Money Laundering (AML)…

Bitcoin Price Prediction: $500 Million in Short Positions Just Got Wiped Out — Is a Bull Market Beginning?

Key Takeaways: Bitcoin experienced a massive short squeeze, liquidating nearly $500 million in short positions and propelling its…

XRP Price Prediction: Ripple Invests Billions to Forge a Connection with Banks – Is $1,000 Possible?

Key Takeaways: Ripple has invested around $4 billion in establishing connections between traditional banks and crypto platforms, illustrating…

Crypto Price Prediction Today 26 February – XRP, Bitcoin, Ethereum

Key Takeaways Bitcoin has rebounded above $68,000, reigniting optimism within the crypto market and potentially signaling a shift…

Google’s Gemini AI Predicts the Price of XRP, Dogecoin, and Shiba Inu by the End of 2026

Key Takeaways Google’s Gemini AI forecasts significant price surges for XRP, Dogecoin, and Shiba Inu by the end…

Wall Street Frontrunning Retail? Institutions Flooded Ethereum Before 15% Price Rally

Key Takeaways Institutional Inflows Surge: A massive $157 million institutional inflow was recorded into Ethereum ETFs in a…

Animoca’s Yat Siu Says AI Agents Will Make 2026 the ‘Year of Utility’

Key Takeaways Animoca’s Yat Siu envisions a future where AI agents and blockchain seamlessly integrate, making 2026 a…

Chainlink Price Surges: What’s Behind Today’s LINK Rally?

Key Takeaways Chainlink’s price has experienced a notable surge, increasing over 14% to reach $9.35, its highest since…

Crypto Exchange Kraken Aims to Reignite Services in India

Key Takeaways Kraken is making strides to re-establish its footprint in the Indian cryptocurrency market. Vishesh Khurana has…

Crypto Rebound: Bitcoin Hits $68,000, Circle’s Revenue Climbs, and NEAR’s Confident Rise

Key Takeaways Bitcoin’s recent surge to $68,000 represents a strategic market rebound, driven by structural support and forced…

MetaMask Expands Mastercard Crypto Card Across the U.S.

Key Takeaways MetaMask has launched its self-custodial crypto card across all 50 U.S. states, broadening the accessibility of…

Bloomberg: A Romanian Presidential Election Intervened by Crypto Traders

Founders Fund, Pantera, and Franklin Templeton join Sentient's "Arena" to stress test enterprise-level AI agents

Why Retail Is Shifting From Crypto to Equities: Will They Return?

Retail traders are exiting the crypto market and gravitating towards equities. Bitcoin saw a notable reduction in spot…

Canton Crypto Network vs. XRP: Understanding DTCC’s Strategic Approach to Infrastructure and Liquidity

Key Takeaways Canton Network and XRP serve distinct roles in blockchain technology: Canton for asset tokenization and atomic…

Jack Dorsey’s Block to Cut 4,000 Jobs in AI-Driven Restructuring

Key Takeaways Block’s significant job cuts aim to streamline operations for AI-driven growth. The company’s stock surged over…

Axiom Crypto Uncovered: ZachXBT Reveals $400k Insider Trading

Key Takeaways Allegations of insider trading at Axiom Crypto involve approximately $400,000 and a complex scheme where employees…