Why is it that in the cryptocurrency field, projects often face difficulties in delivery, also known as "The ICO Curse"?

Original Article Title: Why Crypto Can't Build Anything Long-Term

Original Article Author: rosie

Original Article Translation: Odaily Planet Daily Golem

Most of the crypto founders I know are now on their third pivot. This group developed an NFT platform in 2021, shifted to DeFi yield in 2022, pivoted to AI agents in 2023/24, and are now chasing this quarter's hot trend (maybe prediction markets).

Their pivots aren't wrong, and in many ways, their strategies are right. But the issue is that this pattern itself makes it difficult to build anything that can last long-term.

18-Month Product Cycle

New concept emerges → Funds pour in → Everyone pivots → Sustained growth for 6-9 months → New concept fades → Pivot again.

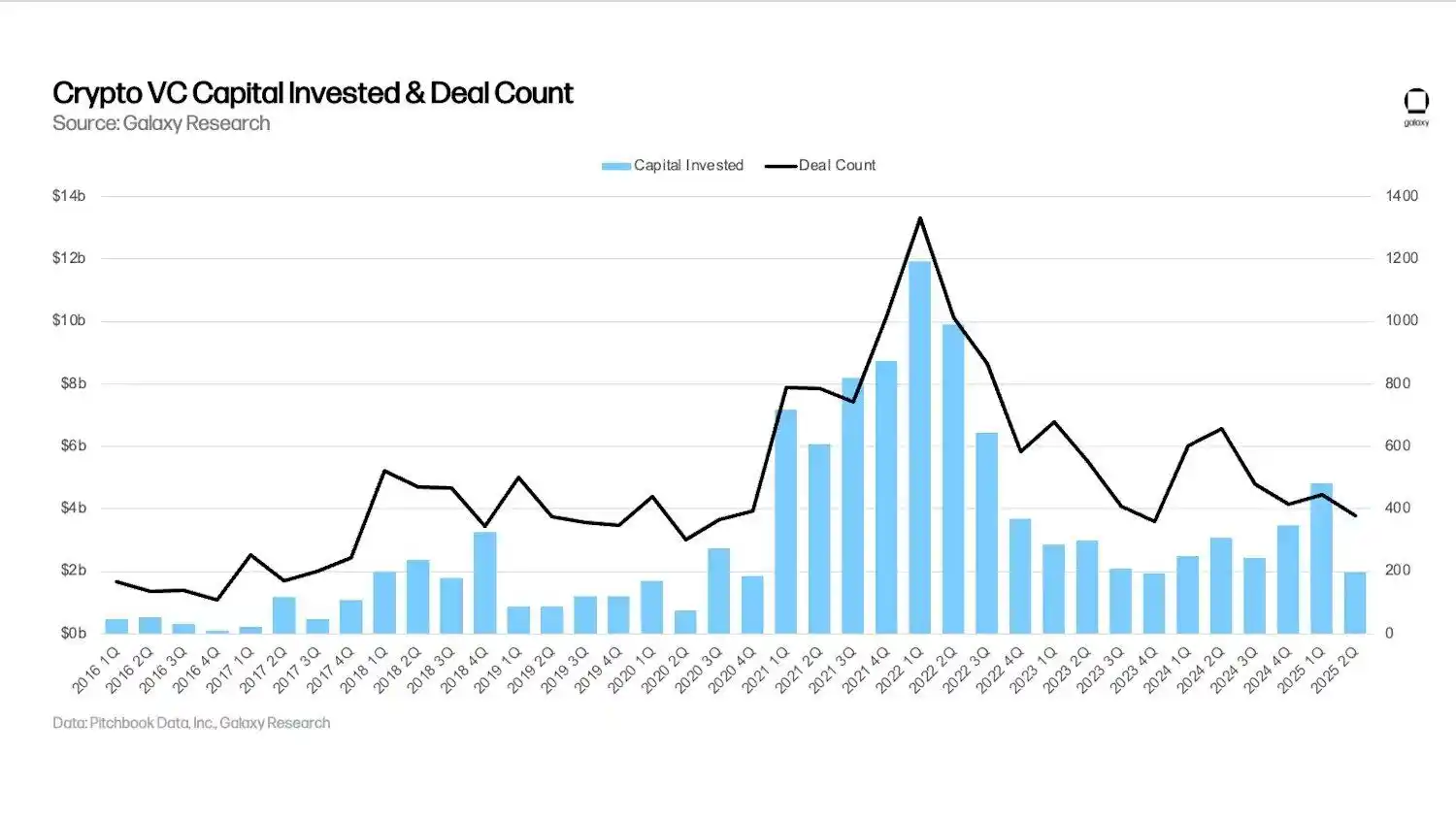

A crypto cycle used to last 3-4 years (ICO era), then shortened to 2 years, and now, if lucky, a crypto cycle lasts at most 18 months. By the second quarter of 2025, crypto VC funding dropped nearly 60%, leaving crypto founders without enough time and funding to develop before the next narrative compels them to pivot again.

It's nearly impossible to build anything meaningful in 18 months; true infrastructure takes at least 3-5 years, and achieving product-market fit truly takes years, not quarters of iteration.

But if crypto founders stick to last year's narrative, they are wasting money, investors will leave, users will churn. Some investors will even force crypto founders to chase the current trend, and their team will start evaluating investments in projects that secured funding based on this quarter's hot narrative.

Sunk Cost Fallacy as a Survival Mechanism

The traditional business advice is not to fall into the sunk cost fallacy. If a project isn't working, pivot immediately. But the crypto space is deeply entrenched in it, using the sunk cost fallacy as a survival mechanism. Now, no one sticks around long enough to validate if what they're doing actually works — facing resistance, pivoting; slow user growth, pivoting; fundraising challenges, pivoting.

Every crypto founder faces this tradeoff:

· Keep building the existing product, maybe achieving success 2-3 years down the line. If lucky, you might secure another round of funding.

· Embrace the hot narrative: raise funds immediately, show superficial progress, and exit before anyone realizes it's not working.

In most cases, the second option wins out.

Projects Forever About to Be Completed

Few crypto projects ever truly complete what they set out to do in their roadmap. Most projects are always in a state of being "about to be completed." Always one feature away from achieving product-market fit. They never get there because halfway through, the winds shift, and overnight, finishing your DeFi protocol becomes irrelevant because everyone is talking about AI agents.

The market punishes completed projects. Because a finished product has its known limitations, while an "about to be completed" product still has infinite narrative potential.

Capital Chases Attention, Not Completion

In crypto, if you have a new narrative, you can raise $50 million even without a product; if the narrative is established, the product is live, you might struggle to raise even $5 million; if it's an old narrative, with a product and real users, then funding might not be possible at all.

Venture capitalists don’t invest in products; they invest in attention. Attention flows to new narratives, not established ones. Most teams now are solely focused on "narrative maximization," optimizing entirely for which story attracts funds, not caring about what they are actually doing. Completing a project boxes you in, while abandoning one keeps your options open.

Team Retention

If you're a crypto founder, when the new narrative arrives, your best engineers might get poached, receiving double the pay to join the latest hot project; your marketing director might be lured by a company that just raised a billion dollars. You can't compete because you abandoned the hot narrative six months ago to truly finish what you started.

No one wants to be part of a boring stable project. They want chaos, excess capital, projects that may fail but could also bring tenfold returns.

User Attention Span

Crypto users sometimes engage with a product simply because it's new, because everyone is talking about it, or because there might be an airdrop. Once the narrative shifts, they move on, and whether the product has improved, or if the requested features have been added, no one cares anymore.

In fact, we cannot build sustainable products for unsustainable users. Some crypto founders pivot so many times that even they forget the original mission.

Decentralized social network -> NFT marketplace -> DeFi aggregator -> Gaming infrastructure -> AI agent -> Prediction market... Transformation is no longer a strategic issue but has become the core of the entire business model.

Infrastructure Paradox

In the crypto space, the things that endure are mostly those that were established before cryptocurrency gained attention. Bitcoin emerged when no one cared, without VCs, and without an ICO. Ethereum was born before the ICO frenzy, before people could envision the future of smart contracts.

Most things born during hype cycles will fade with the end of the cycle, while those born before the cycle are more likely to succeed. Yet few will build before a narrative begins due to lack of funding, attention, and exit liquidity.

Why is This Hard to Change?

Token-based incentive structures create liquidity exit opportunities. As long as founders and investors can exit before the product matures, they will.

The speed of information and emotion spreading far exceeds the speed of construction. By the time a project is done, everyone knows how it turned out. The entire value proposition of the crypto industry is evolving rapidly, demanding slow evolution in a rapidly evolving sector is like expecting it to turn into something it was not meant to be.

This means that if you spend three years building a product, someone else can copy your idea and launch a product with worse code and better marketing strategy in three months. And then they win.

Cryptocurrencies struggle to build any long-term products because structurally they are at odds with long-term thinking.

You can be a principled founder, refuse to pivot, stay true to the original vision, take years instead of months to develop. But you are likely to go bankrupt, be forgotten, and eventually be replaced by those who pivoted three times while you were launching your first version.

The market does not reward completion, but it rewards constantly creating new things. Perhaps the true innovation in the crypto industry lies not in the technology itself, but in how to achieve the maximum value with the minimum input.

You may also like

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market witnesses volatility amid a technology-sector selloff, but opportunities still exist for keen investors.…

Why Is Crypto Down Today, February 6, 2026

Key Takeaways The global cryptocurrency market has seen an 8% decline in the last 24 hours, standing at…

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

Earn

Earn