Don’t Miss Out! How the U.S. 10-Year Treasury Yield Influences Bitcoin Price and Your Crypto Profits with WEEX

Introduction: Why the U.S. 10-Year Treasury Yield and Bitcoin Price Matter Now

The cryptocurrency market is a high-stakes arena, and few factors sway the Bitcoin price like the U.S. 10-year Treasury yield. As a key economic indicator, the yield reflects investor sentiment and monetary policy, directly impacting Bitcoin’s price swings. With Bitcoin’s role as a digital store of value, understanding how the U.S. 10-year Treasury yield influences Bitcoin price is crucial for traders aiming to maximize profits. WEEX, a top-10 global crypto exchange with over 5 million users, offers a secure platform with low fees to navigate these dynamics. This guide explores the relationship, its significance to the crypto industry, and how to trade on WEEX. Don’t miss out—Sign up on WEEX today!

The U.S. 10-Year Treasury Yield and Bitcoin Price: Historical Context and Mechanisms

What is the U.S. 10-Year Treasury Yield?

The U.S. 10-year Treasury yield is the annualized return on a 10-year U.S. Treasury note, a cornerstone of global financial markets. It signals investor confidence, inflation expectations, and Federal Reserve policies. From 2022 to 2025, yields have fluctuated between 3.5% and 4.9%, driven by inflation and Fed rate hikes. As of May 2025, yields hover around 4.0%, reflecting cautious optimism.

Historical Relationship

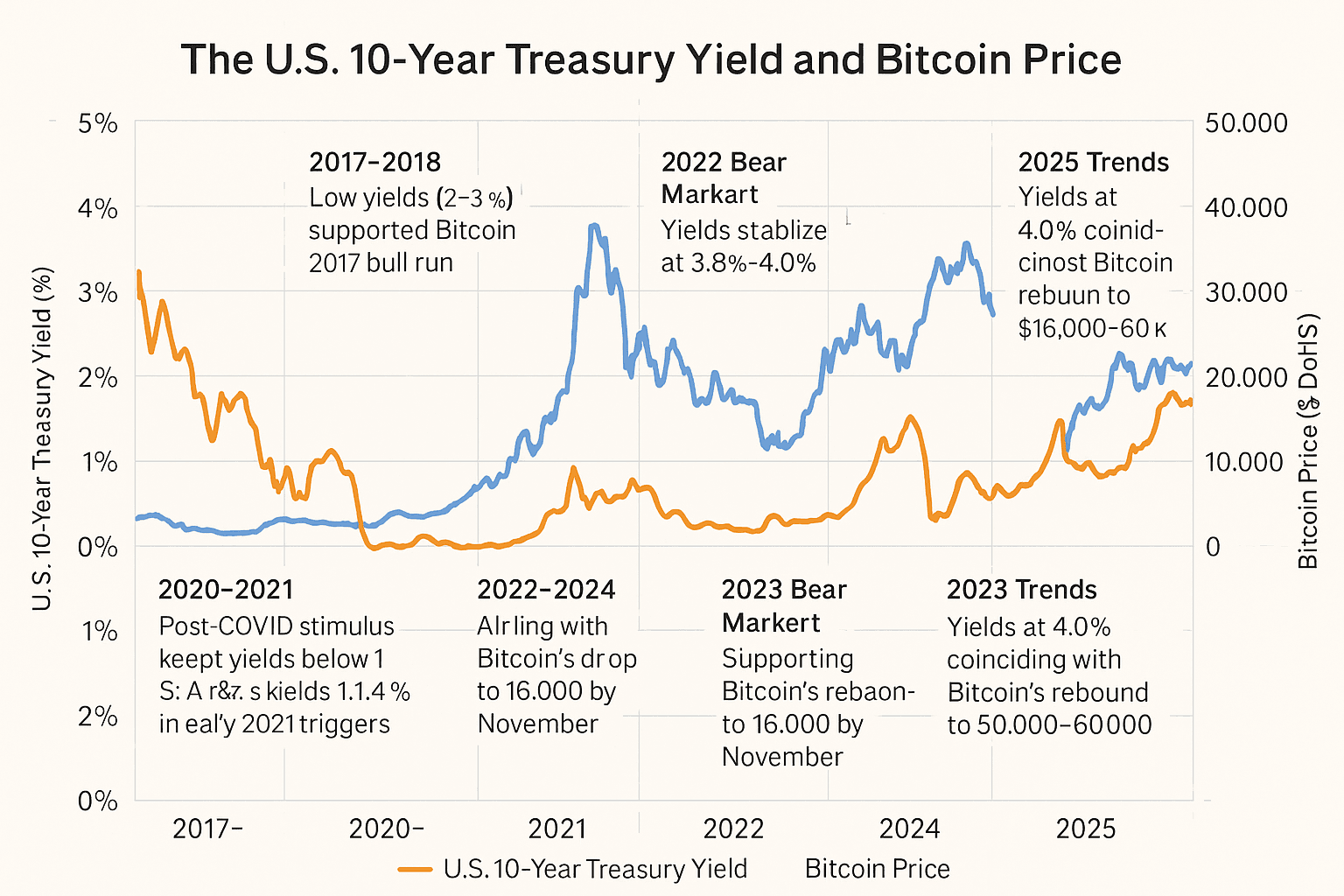

The U.S. 10-year Treasury yield and Bitcoin price often move inversely, as they compete for investor capital:

- 2017–2018: Low yields (2–3%) supported Bitcoin’s 2017 bull run to $20,000. Rising yields in 2018 contributed to a crash to $3,000.

- 2020–2021: Post-COVID stimulus kept yields below 1% in 2020, fueling Bitcoin’s surge from $5,000 to $69,000 by April 2021. A yield rise to 1.44% in early 2021 triggered corrections.

- 2022 Bear Market : Yields spiked to 4.2% amid Fed rate hikes, aligning with Bitcoin’s drop to $16,000 by November.

- 2023–2024 Recovery: Yields stabilized at 3.8%–4.0%, supporting Bitcoin’s rebound to $50,000–$60,000.

- 2025 Trends: Yields at 4.0% coincide with Bitcoin at ~$55,000, but Bitcoin’s reaction to yield surges has been subdued, suggesting a potential decoupling.

Data from 2022–2025 shows a negative correlation of ~0.6 between the U.S. 10-year Treasury yield and Bitcoin price, though crypto-specific factors like regulation can disrupt this.

Mechanisms of Influence

The U.S. 10-year Treasury yield influences Bitcoin price through:

- Risk Sentiment: Rising yields signal tighter monetary policy or inflation concerns, prompting investors to favor bonds over Bitcoin.

- Opportunity Cost: Higher yields make bonds more attractive, reducing capital flow to Bitcoin.

- Inflation Dynamics: Bitcoin is often seen as an inflation hedge, but sustained high yields can trigger sell-offs if bonds offer better returns.

- Liquidity Shifts: During uncertainty, investors flock to Treasurys, reducing Bitcoin demand.

WEEX provides real-time Bitcoin price data to align trades with yield trends.

Analysis: Will the U.S. 10-Year Treasury Yield Continue to Drive Bitcoin Price?

As experienced crypto analysts, we view the U.S. 10-year Treasury yield and Bitcoin price as a barometer of macroeconomic sentiment. Low yields, signaling loose policy or uncertainty, boost Bitcoin as a hedge against inflation or fiat devaluation. High yields, tied to Fed tightening or growth expectations, divert capital to bonds, pressuring Bitcoin’s price. However, 2025 data suggests Bitcoin’s reaction to yield surges is subdued, possibly due to:

- Institutional Adoption: Growing interest via ETFs or corporate treasuries prioritizes Bitcoin’s fundamentals.

- Decoupling Trend: Bitcoin may be evolving into a unique asset class, less tied to traditional markets.

For late 2025, we predict:

- Bullish Scenario: If yields stabilize at 3.5%–4.0%, Bitcoin could rally to $70,000, driven by adoption and innovations like BRC-20 tokens.

- Bearish Risk: A yield spike to 5%, due to inflation or geopolitical tensions, could push Bitcoin below $50,000, as in 2022.

Factors like regulatory clarity or global economic shifts could alter this dynamic.

Why This Matters to the Crypto Industry

The U.S. 10-year Treasury yield and Bitcoin price relationship shapes the crypto landscape:

- Market Sentiment: High yields signal risk-off sentiment, reducing crypto demand; low yields boost Bitcoin’s appeal.

- Trading Opportunities: Yield-driven volatility creates prospects for futures trading with up to 200x leverage on WEEX.

- Portfolio Strategy: Understanding this dynamic helps balance crypto and traditional assets.

- Institutional Impact: Stable yields could accelerate institutional adoption, boosting Bitcoin demand.

How to Trade Bitcoin on WEEX Amid Yield-Driven Volatility

To leverage how the U.S. 10-year Treasury yield influences Bitcoin price, follow these steps on WEEX:

- Register: Sign up on WEEX and complete KYC for full access.

- Deposit Funds: Add BTC or USDT via the platform’s deposit feature.

- Monitor Yields: Track yield updates (e.g., via Bloomberg) and Bitcoin prices on WEEX.

- Trade Futures: Access BTC/USDT pairs with up to 200x leverage. Practice risk-free with WEEX’s futures tools.

- Manage Risk: Set stop-loss orders to handle volatility. Enjoy low fees (0.02% maker) to maximize profits.

- Get Support: Visit the FAQ for trading guidance.

FAQs

- How does the U.S. 10-year Treasury yield influence Bitcoin price?

Rising yields often reduce Bitcoin’s price by favoring bonds; falling yields boost demand. Trade on WEEX to seize opportunities. - Is Bitcoin a good investment when yields rise?

It can hedge inflation initially, but high yields may trigger sell-offs. Test strategies on WEEX. - Why trade on WEEX?

WEEX offers low fees, high leverage, and robust security. - How can I track yield-driven Bitcoin price trends?

Use WEEX’s real-time data for market insights (see FAQ).

Conclusion

The U.S. 10-year Treasury yield influences Bitcoin price by shaping investor sentiment and capital flows, creating volatility and opportunity. While historically inverse, recent subdued reactions suggest Bitcoin may be decoupling. WEEX empowers traders with a secure platform and low fees to profit from these dynamics. Start today—Sign up on WEEX and unlock crypto profits!

You may also like

What is Nebula3 (SN3) Coin?

Nebula3 (SN3) has recently made waves in the crypto market, particularly with its new listing on the WEEX…

SN3 USDT Premiere on WEEX: Nebula3 (SN3) Coin Debuts

WEEX Exchange proudly announces the world premiere listing of Nebula3 (SN3), a groundbreaking GameFi token blending AI, DeFi,…

Nebula3 (SN3) Coin Price Prediction & Forecasts for March 2026: Surging 9.9% Amid New Listings

As of March 11, 2026, Nebula3 (SN3) Coin is trading at $0.03179, reflecting a 9.9% increase over the…

Introducing PlaysOut ($PLAY): Platform Updates and Pump Potential

PlaysOut is a high-performance publishing infrastructure. $PLAY powers the ecosystem.The continuous climb in $PLAY over 1 week has captured market attention.

What is Distorted Face (DISTORTED) Coin?

The [Distorted Face (DISTORTED)] token has recently made waves in the crypto community, thanks to its unique origin…

DISTORTED USDT Premiere Listing on WEEX: Distorted Face (DISTORTED) Coin Debuts

WEEX Exchange proudly announces the exclusive premiere listing of Distorted Face (DISTORTED), a meme-inspired token that’s capturing attention…

Distorted Face (DISTORTED) Coin Price Prediction & Forecasts for March 2026: Could This Meme Token Surge After WEEX Listing?

As of March 11, 2026, the current price of Distorted Face (DISTORTED) Coin stands at $0.00285, according to…

ULTIMA Coin Price Prediction & Forecasts for March 2026: Surging 3.3% with Eyes on $6,000 Breakout

Ultima (ULTIMA) has been turning heads in the crypto space lately, especially with its scalable blockchain powering everyday…

XBR USDT Listed on WEEX Futures: Brent Crude Oil (XBR) Coin

WEEX Exchange lists Brent Crude Oil (XBR) Coin. Trade XBR USDT futures starting Mar 11, 2026. Access global energy markets with competitive WEEX Trading Fees.

SN3 USDT Live on WEEX Futures: Nebula3 (SN3) Listing

Trade Nebula3 (SN3) Coin on the newly listed SN3 USDT perpetual contract. WEEX Exchange offers up to 20x leverage for this high-growth GameFi project.

NOOK USDT Premiere: nookplot (NOOK) Coin Debuts on WEEX

WEEX Exchange is thrilled to announce the exclusive premiere listing of nookplot (NOOK) Coin, starting with NOOK USDT…

Is United Global Oil Reserve (UGOR) Crypto a Good Investment in 2026? Expert Analysis and Price Forecasts

The United Global Oil Reserve (UGOR) crypto has been making waves in the intersection of traditional energy markets…

What is nookplot (NOOK) Coin?

nookplot (NOOK) has recently made its debut on WEEX Exchange, becoming an exciting addition to the crypto trading…

What Is United Global Oil Reserve (UGOR) Coin in 2026: Exploring This Oil-Backed Crypto Asset

As we move through 2026, the crypto market continues to blend traditional assets with blockchain technology, and United…

nookplot (NOOK) Coin Price Prediction & Forecasts for March 2026: Could It Surge Amid New Listings?

As of March 10, 2026, the current price of nookplot (NOOK) Coin stands at $0.0000293, according to data…

What Is OLIO (OIL) Coin in 2026: Exploring OLIO Crypto’s Market Potential and Price Outlook

As we move through 2026, OLIO (OIL) Coin has caught the eye of many in the crypto space,…

Is OLIO Crypto (OIL Coin) a Good Investment in 2026? Expert Analysis and Price Forecasts

As we move through 2026, OLIO Crypto, often referred to as OIL Coin, has caught the eye of…

OLIO Crypto: Is There an Oil Crypto Coin Like the OIL Token?

As we move through 2026, the crypto market continues to blend traditional commodities with blockchain innovation. Take OLIO…

What is Nebula3 (SN3) Coin?

Nebula3 (SN3) has recently made waves in the crypto market, particularly with its new listing on the WEEX…

SN3 USDT Premiere on WEEX: Nebula3 (SN3) Coin Debuts

WEEX Exchange proudly announces the world premiere listing of Nebula3 (SN3), a groundbreaking GameFi token blending AI, DeFi,…

Nebula3 (SN3) Coin Price Prediction & Forecasts for March 2026: Surging 9.9% Amid New Listings

As of March 11, 2026, Nebula3 (SN3) Coin is trading at $0.03179, reflecting a 9.9% increase over the…

Introducing PlaysOut ($PLAY): Platform Updates and Pump Potential

PlaysOut is a high-performance publishing infrastructure. $PLAY powers the ecosystem.The continuous climb in $PLAY over 1 week has captured market attention.

What is Distorted Face (DISTORTED) Coin?

The [Distorted Face (DISTORTED)] token has recently made waves in the crypto community, thanks to its unique origin…

DISTORTED USDT Premiere Listing on WEEX: Distorted Face (DISTORTED) Coin Debuts

WEEX Exchange proudly announces the exclusive premiere listing of Distorted Face (DISTORTED), a meme-inspired token that’s capturing attention…