Uptober Effect 2025: The Bitcoin Rally You Need to Watch

Bitcoin has had an impressive start to October 2025. Since the beginning of the month, Bitcoin’s price has surged by 8.5% at the time of writing, breaking through key resistance levels and reaching new highs. The month of October has become synonymous with Bitcoin rallies over the years, earning it the nickname "Uptober." The term was first coined by traders on platforms like Reddit and Twitter between 2013 and 2017, combining "Up" and "October" to reflect Bitcoin’s consistent bullish performance in this month. This trend has made "Uptober" more than just a meme; it’s now an expected seasonal pattern that traders and institutional investors watch closely.

October Bitcoin Surge: ETF Inflows, Exchange Balance Drop, Stablecoin Growth

Several key market indicators consistently highlight Bitcoin's price movements during October, offering valuable insights for crypto traders and investors. ETF inflows are one of the most important factors driving the current surge. According to SoSoValue, Bitcoin ETFs have seen 5 consecutive days of net inflows since September 29, with daily total net inflows ranging from $429M to $985M (on October 3, the latest data on SoSoValue), which is in line with Bitcoin's price movement. These inflows reflect institutional investors' growing interest in Bitcoin. Notably, this week’s inflow number is the largest weekly inflow on record for Spot Bitcoin ETFs this year.

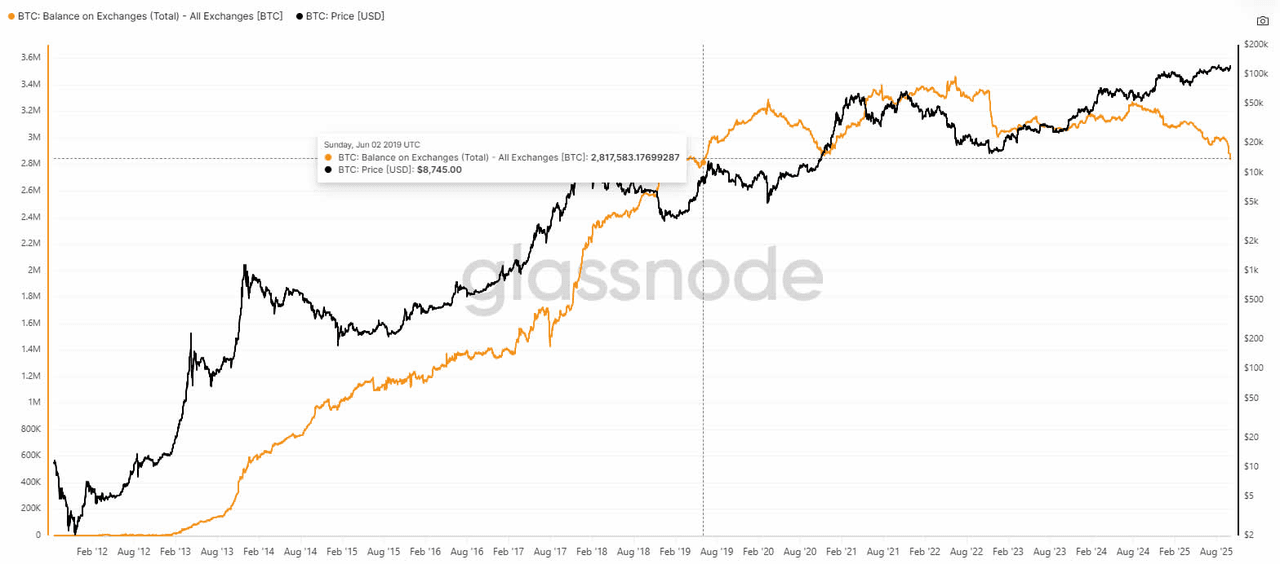

Another critical indicator is Bitcoin's decreasing exchange balances. As is shown by Glassnode, the total Bitcoin balance on centralized exchanges fell to a six-year low of 2.83 million BTC on October 4, signaling that many large holders are moving their BTC off exchanges in anticipation of price increases. This creates a supply crunch that drives prices higher.

In addition to spot ETF inflows and exchange balance decrease, onchain indicators show that whales are aggressively buying BTC and ETH. According to on-chain analytics tracker Lookonchain, from September 29 to October 5, stablecoin supply increased by $5.48B, while institutions like Bitmine and Metaplanet continued heavy accumulation of BTC and ETH, driving their prices towards higher highs.

Why October? Key Macro and Market Drivers Behind "Uptober"

October’s price surge is no accident, it’s the result of multiple macroeconomic, structural, and cyclical drivers. A major factor is the quarterly asset rebalancing done by global institutional investors. After a slow September, institutions typically begin re-evaluating their portfolios and re-enter the market at the start of October. This period of reallocation is often called "Q4 Rebalancing," and it frequently benefits high-volatility assets like Bitcoin and Ethereum. In addition to this, October coincides with several major crypto events including TOKEN2049, creating an environment of heightened market activity.

Alongside these structural factors, there’s also a psychological element at play. The "Uptober" phenomenon has become so ingrained in the minds of traders and institutional investors that many start positioning for October months in advance. The psychological anticipation of Bitcoin’s historic October rally adds an element of self-fulfilling prophecy, with more funds pouring into the market as traders prepare for price movements. Finally, October marks a critical point in Bitcoin’s price cycles. In many bull markets, October has been the month when Bitcoin breaks through key resistance levels, fueling the next phase of its rally.

Macro Trends in 2025: What Makes This October So Special for Bitcoin

Looking at the broader picture, 2025’s October surge is underpinned by macroeconomic trends and institutional behaviors that align perfectly with Bitcoin’s price movements. One major factor is the ongoing shift in global monetary policies. As the Federal Reserve released signals to lower interest rates, riskier assets like Bitcoin become more attractive, and institutions are increasingly using Bitcoin ETFs to gain exposure to the digital asset class.

Political uncertainty, particularly surrounding the U.S. government shutdown and other geopolitical risks, also drives funds away from traditional assets like the dollar and bonds, pushing investors toward decentralized assets like Bitcoin. This shift from fiat to crypto is creating a favorable environment for Bitcoin to thrive. With Bitcoin’s price now sitting at a key technical level, it has triggered massive demand for Bitcoin from both passive investment strategies and trend-following traders. The combination of all these factors has created a perfect storm for Bitcoin’s bullish October.

What Does “Uptober” Mean for WEEX Users?

For WEEX users, October presents a unique period shaped by notable macroeconomic and market dynamics. With the “Uptober” effect historically aligning with strong Bitcoin performance, the market may continue to experience heightened activity throughout the month. By paying attention to ETF inflows, whale movements, and broader macroeconomic developments, users can stay informed about evolving market conditions. Institutional participation through Bitcoin ETFs and potential regulatory developments may also play a significant role in shaping sentiment and volatility. The combination of technical indicators and macro factors provides a noteworthy backdrop for observing potential market trends. Staying updated and responsive to new information is key during this dynamic period for the crypto market.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, financial advice, trading advice, or any other form of recommendation. WEEX does not provide investment advice. Users should conduct their own research and consult with professional advisors before making any investment decisions.

You may also like

IREN Tokenized Stock (IRENON) Coin Price Prediction & Forecasts for January 2026: Could It Rebound Amid RWA Surge?

As a crypto investor who’s spent years trading tokenized assets, I’ve watched projects like IREN Tokenized Stock (IRENON)…

Lazy Summer (SUMR) Coin Price Prediction & Forecasts for January 2026 – Fresh Launch Sparks Early Rally Potential

Lazy Summer (SUMR) Coin burst onto the scene with its launch on January 22, 2026, quickly drawing attention…

Is MSTR Riskier Than BTC? A Deep Dive into MicroStrategy Stock vs. Bitcoin for Crypto Investors

MicroStrategy Inc., the business intelligence firm led by Michael Saylor, has made headlines again with its massive Bitcoin…

Can MSTR Hit $1000? Expert Price Predictions and Market Outlook for 2026

MicroStrategy’s stock, ticker MSTR, has been making waves in the crypto world due to its massive Bitcoin holdings,…

Is MSTR a Good Buy in 2026? Expert Insights on MicroStrategy Stock and Crypto Ties

MicroStrategy Inc., known for its massive Bitcoin holdings, has seen its stock (MSTR) surge in recent months, driven…

MSTR Coin Price Prediction & Forecast: Could It Surge 25% in January 2026 Amid Bitcoin Rally?

MicroStrategy’s MSTR stock, now tokenized as MSTR Coin on platforms like WEEX Exchange, has been making waves since…

YOMAMA Coin Price Prediction & Forecasts for January 2026 – Could It Surge 50% Post-Launch?

YOMAMA Coin is making waves in the meme coin space, inspired by a viral Twitter post about liberal…

雪球人生 Coin Price Prediction & Forecasts for January 2026: Could This Meme Token Surge on Launch Momentum?

If you’re eyeing the latest in meme coins, 雪球人生 Coin just hit the scene with its exclusive launch…

CLIPPYSOL (Clippy) Coin Price Prediction & Forecasts for January 2026: Could This Meme Coin Surge After Launch?

Dive into the world of CLIPPYSOL (Clippy) Coin, the latest meme token making waves on the Solana blockchain.…

YOMAMA Coin Price Prediction & Forecasts for January 2026: Could This Meme Token Surge on Launch Day?

YOMAMA Coin is set to make its exclusive debut today on WEEX Exchange at 11:30 AM, drawing from…

Is Coinbase Global Inc. (COIN) a Good Investment? Price Predictions, Analysis & Trading Guide

Is Coinbase Global Inc. (COIN) a Good Investment? trade COIN perpetual contracts on weex exchange

How to Buy Bitcoin on WEEX Exchange: Your Ultimate Guide to Purchasing Bitcoin

How to Buy Bitcoin on WEEX Exchange

MEMES Coin Price Prediction 2026: Can This Meme Token Survive the Hype Cycle?

trade MEMES on weex exchange

BEEPE Coin Price Prediction & Forecasts for January 2026: Potential Surge as Meme Hype Builds Post-Launch

BEEPE Coin, a fresh meme token blending the iconic Pepe the Frog with bee-themed humor on the Binance…

北极熊踏雪归来 (北极熊2026) Coin Price Prediction & Forecasts for January 2026 – Could It Surge on Launch Day?

The 北极熊踏雪归来 (北极熊2026) Coin is making waves as a fresh meme cryptocurrency launching today on the BNB Chain.…

我是未来 Coin Price Prediction & Forecasts: Could This Meme Token Rebound After Launch Volatility in January 2026?

我是未来 Coin burst onto the scene on January 21, 2026, as a fresh meme token on the Binance…

Best AI Models for Crypto Trading in 2026: Which One Tops the Charts?

As we move through early 2026, AI for crypto trading has grabbed headlines with impressive performance gaps among…

Is There an AI for Crypto Trading? A Beginner’s Guide to Tools, Strategies, and Real-World Performance

As of January 21, 2026, the crypto market continues to buzz with advancements in artificial intelligence, particularly after…

IREN Tokenized Stock (IRENON) Coin Price Prediction & Forecasts for January 2026: Could It Rebound Amid RWA Surge?

As a crypto investor who’s spent years trading tokenized assets, I’ve watched projects like IREN Tokenized Stock (IRENON)…

Lazy Summer (SUMR) Coin Price Prediction & Forecasts for January 2026 – Fresh Launch Sparks Early Rally Potential

Lazy Summer (SUMR) Coin burst onto the scene with its launch on January 22, 2026, quickly drawing attention…

Is MSTR Riskier Than BTC? A Deep Dive into MicroStrategy Stock vs. Bitcoin for Crypto Investors

MicroStrategy Inc., the business intelligence firm led by Michael Saylor, has made headlines again with its massive Bitcoin…

Can MSTR Hit $1000? Expert Price Predictions and Market Outlook for 2026

MicroStrategy’s stock, ticker MSTR, has been making waves in the crypto world due to its massive Bitcoin holdings,…

Is MSTR a Good Buy in 2026? Expert Insights on MicroStrategy Stock and Crypto Ties

MicroStrategy Inc., known for its massive Bitcoin holdings, has seen its stock (MSTR) surge in recent months, driven…

MSTR Coin Price Prediction & Forecast: Could It Surge 25% in January 2026 Amid Bitcoin Rally?

MicroStrategy’s MSTR stock, now tokenized as MSTR Coin on platforms like WEEX Exchange, has been making waves since…